January 21 2019

“The time is always right to do what is right.”

MLK JR

January 19 2019

The Cost of Waiting To Buy!

•Freddie Mac predicts interest rates to rise to 5.1% by the end of 2019.

•CoreLogic predicts home prices to appreciate by 4.8% over the next 12 months.

If you are ready and willing to buy your dream home, find out if you are able to. Give me a call!

January 15 2019

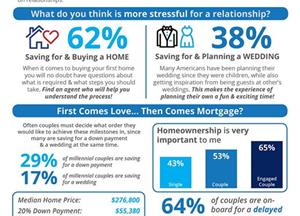

Is Buying a Home Really More Stressful Than Planning a Wedding?

According to a survey from Open Listings, 62% of Americans ages 25-54 believe that buying a home is more stressful than planning a wedding.

Many young couples are saving for a wedding and a home at the same time.

The average US wedding now costs 66% of a median home down payment, according to The Knot.

Give me a call to see how much down payment you really need to buy the home of your dreams! It may be easier than you think!

January 14 2019

Are You Thinking About Buying a House This Year?

Speaking With Me Should Be Your 1st Step!

Many potential homebuyers overestimate the down payment and credit scores necessary to qualify for a mortgage.

Some of topics we will discuss are:

Capacity: Your current and future ability to make your payments

Capital or cash reserves: The money, savings, and investments you have that can be sold quickly for cash

Collateral: The home, or type of home, that you would like to purchase

Credit: Your history of

January 11 2019

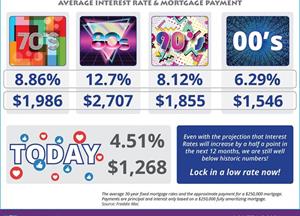

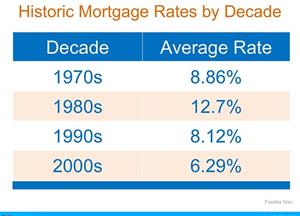

With interest rates still around 4.5%, now is a great time to look back at where rates have been over the last 40 years.

Rates are projected to climb to 5.0% by this time next year according to Freddie Mac.

The impact your interest rate makes on your monthly mortgage cost is significant! Lock in a low rate now while you can! Give me a call today!

January 3 2019

Adjustable Rate Mortgages: Have you seen our rates?

Top Two Reasons an ARM Mortgage Is a Good Idea

•Lower rates help you build equity faster

•Time is on your side

If you don't plan to live in a home for 30 years, why borrow for 30 years to buy it? If you orrow on a 30-year term to finance a home you plan to live in for just five or 10 years you will pay thousands of dollars more in interest, and own less of your home when you sell it.

If you are interested in our rates or information on an ARM give

January 2 2019

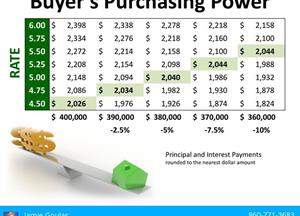

Purchasing Power and Rates

The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power.

Purchasing power is the amount of home you can afford to buy for the budget you have available to spend. As rates increase, the price of the house you can afford to buy will decrease if you plan to stay within a certain monthly housing budget.

Mortgage interest rates had been on the rise for much of 2018, but they made a welcome

December 28 2018

Where is the Housing Market Headed in 2019?

•Interest rates are projected to increase steadily throughout 2019.

•Home prices will rise at a rate of 4.8% over the course of 2019 according to CoreLogic.

•All four major reporting agencies believe that home sales will outpace 2018!

December 26 2018

How to Save Thousands of Dollars in Interest on Your Mortgage

1. Pay an additional 1/12th of your mortgage payment every month

2. Pay an additional $50 per month towards your mortgage

3. Make one-time lump sum payments when you can

If you’re wondering what strategies would work best for you to shorten the term of your loan, let’s get together to answer your questions.

December 18 2018

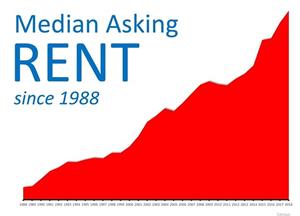

Rents are still on the rise. If you've been thinking you can't buy a home, you may be surprised!

Call me to talk about your options! 860-771-3683

December 11 2018

Don't be a character in this story!

Give me a call, let's start the home buying process!

There's a lot of programs available!

#chfa #firsttimebuyer #homeowner #mortgage #equity

December 10 2018

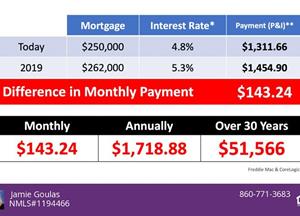

What If I Wait A Year to Buy a Home?

The Mortgage Bankers Association (MBA), Freddie Mac, and Fannie Mae all project that mortgage interest rates will increase by this time next year. According to CoreLogic’s most recent Home Price Insights Report, home prices will appreciate by 4.8% over the next 12 months.

What Does This Mean?

If home prices appreciate by 4.8% over the next twelve months as predicted by CoreLogic, below is a simple demonstration of the impact that an increase in interest rate

December 3 2018

Reasons To Buy A Home This Winter:

•Prices Will Continue to Rise in 2019. Corelogic predicts that prices will continue to increase at a rate of 4.7% over the next year.

•Mortgage Interest Rates Are Projected to Increase. Most experts predict that rates will rise over the next 12 months.

•Either Way, You are Paying a Mortgage. As a renter, you guarantee your landlord is the person building that equity - maybe it's time to build some equity for yourself.

•It’s Time to Move on With Your Life.

If the

November 28 2018

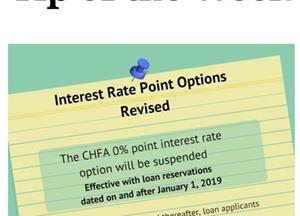

Big CHFA Changes for 2019:

CHFA currently offers two rate options. Beginning January 1, 2019 the CHFA 0 point option will no longer be available and all loan applicants are required to pay 1 point rate option.

Give me a call if you have questions.

November 27 2018

The #1 Reason to Not Wait Until Spring to Sell Your House

Your Home in the Winter Months is Less Competition!

Housing supply traditionally shrinks at this time of year, so the choices buyers have will be limited. The chart below was created using the months’ supply of listings from the National Association of Realtors.

If you have been debating whether or not to sell your home and are curious about market conditions in your area, now is the best time to connect with a realtor. Give me a call to

November 21 2018

Happy Thanksgiving Eve!

Below are some fun facts to share about the day as you gather around the table with loved ones.

I am thankful for your continued trust, business and referrals!

November 20 2018

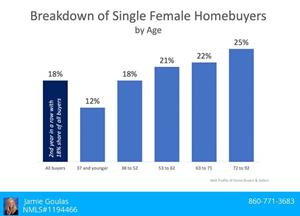

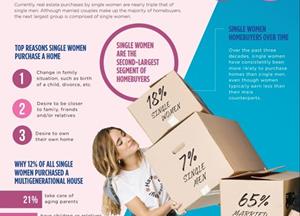

Females Are Making It a Priority to Invest in Real Estate!

In 2018, for the second year in a row, single female buyers accounted for 18%of all buyers.

According to the 2018 Home Buyer and Seller Generational Trends Report by the National Association of Realtors, one in five homebuyers in the U.S. were single females (most of them part of the baby boomer generation) as you can see in the graph below.

It's a great time to buy, let’s get together to help you create your real estate portfolio so that

November 16 2018

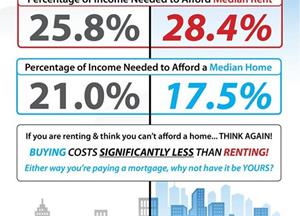

The Cost of Renting vs. Buying a Home

•Historically, the choice between renting or buying a home has been a tough decision.

•Looking at the percentage of incomeneeded to rent a median-priced home today (28.4%) vs. the percentage needed to buy a median-priced home (17.5%), the choice becomes obvious.

Every market is different. Before you renew your lease again, find out if you can put your housing costs to work by buying this year!

November 14 2018

Did you know CHFA has a Military Homeownership Program offering an additional 0.125% off the amazing CHFA rate!

The program is available to veterans and members of the US Military.

Give me a call today to take advantage of this program!

November 12 2018

Did You Know - Closing Costs:

If you are limited on savings, you can work seller-paid closing costs into your offer. This will help you with your out of pocket expenses.

This could be a great strategy to enhance your ability to get a mortgage.

Need help with down payment? Give me a call me have a few options for you!

November 11 2018

Today we honor all who serve and have served, remembering them every day!

#militaryspouse

November 9 2018

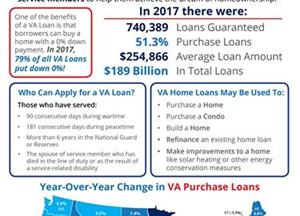

VA Loans are on the Rise

•The Veterans Administration (VA) Home Loan is a benefit that is available to more than 22 million veterans & 2 million active duty service members which helps them achieve their dreams of homeownership.

•In 2017, $189 billion was loaned to veterans and their families through the program.

•VA Purchase Loans are on the rise in 46 out of 50 states and Washington, DC.

November 5 2018

2 Myths Holding Back Home Buyers

Myth #1: “I Need a 20% Down Payment”

Many future buyers believe that they need at least 20% down payment to buy a home, they do not realize that there are programs available which allow them to put down as little as 0 to 3% down!

Myth #2: “I Need a 780 FICO Score or Higher to Buy”

Many Americans believe a ‘good’ credit score is 780 or higher.

To help debunk this myth, look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved)

November 2 2018

The Difference One Hour Will Make This Fall!

Every Hour in the US Housing Market:

•596 Homes Sell

•278 Homes Regain Positive Equity

•Median Home Values Go Up $1.20

October 31 2018

This Halloween let me take the fear out of the Mortgage Process! 👻

1. Find out your current credit history & score – even if you don’t have perfect credit, you may already qualify for a loan.

2. Start gathering all of your documentation – income, assers, etc

3. Contact me, a knowledgeable lender – to review your income, expenses, and financial goals in order to determine the type and amount of mortgage you qualify for.

Nothing scary about it! Call me today!

Happy Halloween! 🎃

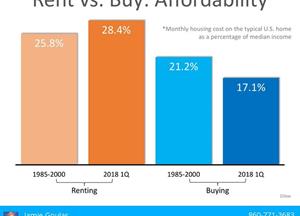

October 30 2018

Are You Spending TOO Much on Rent?

The chart below compares the historic percentage of income needed to rent and buy from 1985-2000 to the first quarter of 2018. As you can see, the cost of renting has climbed above historic numbers while the cost of buying dropped over the same period of time.

If you are spending too much of your monthly income on rent, let's talk to see what your buying options are!

We offer low to NO down payment mortgages.

Give me a call today!

#chfa #usda #homebuyer

October 26 2018

Don't be spooked away from buying a house, know the facts!

I'm here to help, let's schedule a time to talk!

October 24 2018

Still Think You Need 15-20% Down to Buy a Home? Think Again!

We offer loans with NO down payment required. We also offer programs that provide grants and loans to make homeownership more attainable.

If you have questions about your ability to buy in today’s market, let’s get together so we can assist you along your journey!

October 23 2018

Community Heroes Homeownership Program (1% down payment!)

Individuals and families who have at least one loan applicant employed as a full-time EMT, firefighter, paramedic, police officer or teacher (K-12) may be eligible to purchase a home with only a 1% down payment requirement, and up to $500 off closing costs.

Eligible for properties in CT and RI.

Give me a call today!

October 16 2018

A $133 million fund has been set up by the state to help homeowners with failing foundations.

On Nov. 15, applications will begin being accepted from homeowners seeking state funds to replace their failing foundations. This money should help 700 homes in CT.

It's definitely a start.

http://www.courant.com/breaking-news/hc-news-crumbling-concrete-captive-insurance-20181015-story.html

October 15 2018

I am a statistics geek and these I had to share!

According to the National Association of Realtors, currently, real estate purchases by single woman are nearly triple that of single men. The average age of single woman homebuyers is 35!

I love to help people buy a home. If you need some assistance give me a call I would love to help.

October 12 2018

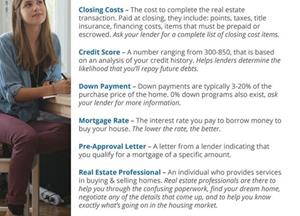

Buying a Home? Do You Know the Lingo?

The best way to ensure that your home-buying process is a confident one is to find a real estate professional who not only puts your family’s needs first, but will guide you through every aspect of the transaction with ‘the heart of a teacher.’

My favorite part of my job is not only closing deals but educating all my borrowers and friends! It's so important to understand the process. If you need help, give me a call!

#knowbeforeyougo

October 11 2018

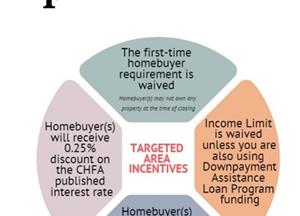

CHFA Tip of the Week: Targeted Areas

CHFA has designated "Targeted Areas" in Connecticut. These are areas of the State that would benefit from increased homeownership.

The benefits to buying in a Targeted Area:

•The interest rate on the mortgage loan is reduced by 0.25% for borrowers purchasing a home in a Targeted Area.

•The first-time homebuyer requirement is waived in Targeted Areas (homebuyers may not own any property at the time of closing.)

•Income limits are also waived in Targeted

October 10 2018

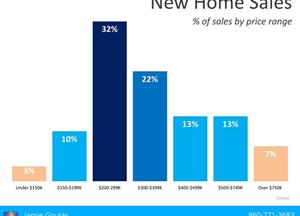

New Home Sales Up 12.7% From Last Year

According to the latest New Residential Sales Report from the Census Bureau, new construction sales in August were up 3.5% from July and 12.7% from last year! This marks the second consecutive month with double-digit year-over-year growth (12.8% in July).

The report also states that the percentage of new construction sales in the $200-$299k range has continued to break away from the $300-$399k range.

This shows that builders are starting to build lower-priced

October 3 2018

Rates, Rates, Rates..

When it comes to today’s real estate market, the top two factors to consider are what’s happening with interest rates & inventory.

I'm going to talk interest rates. Mortgage interest rates have been on the rise and are now over three-quarters of a percentage point higher than they were at the beginning of the year.

The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power.

Experts predict that

October 2 2018

Mortgage Interest Rates are Still Going Up… Should You Wait to Buy?

Mortgage interest rates, as reported by Freddie Mac, have increased by close to a quarter of a percent over the last several weeks. Freddie Mac, Fannie Mae, the Mortgage Bankers Association, and the National Association of Realtors are all calling for mortgage rates to rise another quarter of a percent by next year.

The chart below is showing the average mortgage interest rate over the last several decades.

Though you may have

October 2 2018

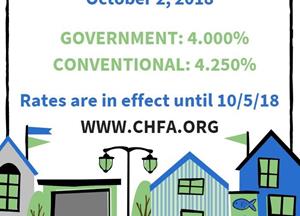

October 2, 2018: CHFA's Interest Rate Update

Give me a call today to see if you qualify for this wonderful program!

September 26 2018

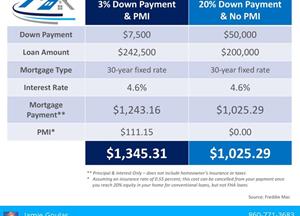

Saving for a down payment is often the biggest hurdles for a first-time homebuyer. There is a common misconception that homebuyers need to put down 20% as their down payment.

One thing to keep in mind is that it takes time to save money for a large downpayment and today's rapidly changing housing market this could mean higher home prices and rates. For many buyers it may be cheaper to opt for the 3% down payment option.

If you have questions about whether you should buy now or wait until you’ve